BUSINESS

5 Reasons Cp As Are Crucial For Audit Readiness

Facing an audit can shake your sense of security. You want clear records, clean numbers, and no surprises. That is where a CPA steps in. A CPA guides you through tax rules, reporting demands, and tight deadlines. This support protects you from penalties and stress. You gain order, proof, and control. Every business needs that. Even if you already work with a tax accountant in Texarkana, TX, a CPA gives you a stronger defense. Auditors look for accuracy, consistency, and clear support for every figure. You must show that your books match your claims. You also must show that your controls work. A CPA helps you build that proof before anyone knocks on your door. This blog explains five clear reasons you should not wait until an audit notice arrives. You can prepare now, avoid fear, and face any review with steady confidence.

1. You build clean records before an audit starts

Audit readiness starts with daily habits. A CPA helps you set those habits and keep them.

You get help to:

- Set a clear chart of accounts that matches your business

- Record income and expenses the same way every time

- Store receipts, invoices, and contracts in an easy system

The IRS explains that good records support every number on your return and shorten audits.

A CPA reviews your books often. You fix mistakes while they are small. You avoid a rushed cleanup when you get an audit letter. That calm control protects your business and your family from sudden stress.

2. You understand risk and lower it early

Every business has audit risk. You may have cash sales, home office costs, or complex payroll. A CPA studies your patterns and points out risk before an auditor does.

A CPA helps you:

- Spot numbers that look odd or jump from year to year

- Check that deductions match IRS rules

- Review high risk items such as travel, meals, and contractor pay

Then you can choose simple fixes. You can adjust how you pay yourself. You can change how you track mileage. You can correct past returns when needed.

This early action lowers the chance of an audit. It also reduces the pain if an audit happens. You already have reasons and proof ready.

3. You gain clear support for every number

Auditors ask one question again and again. They ask how you got to each number. A CPA helps you answer that with calm and clarity.

With a CPA, you can build support in three steps.

- Use written policies for how you record common items

- Match bank statements to your books each month

- File backup documents in a way that others can follow

Colleges that teach accounting stress this kind of support. The same ideas help during an audit. Every figure needs a clear trail.

When you follow this pattern, you do not scramble for records. You do not fear each question. You show respect for the rules and protect your name in your community.

4. You strengthen controls that protect your money

Audits do not look at numbers alone. They also look at how you handle money. Strong controls show that you care about honesty.

A CPA can review how you:

- Approve payments and sign checks

- Handle cash and deposits

- Separate duties so one person does not control everything

Then you can improve weak spots. You might add a second review for large checks. You might require two people to count cash. You might use simple software controls.

These steps protect your family income from loss and theft. They also give auditors confidence that your numbers are not random. Strong controls turn a harsh audit into a shorter review.

5. You gain calm support during the audit itself

No one wants to face an auditor alone. A CPA stands with you and speaks the same language as the examiner.

During an audit, a CPA can:

- Review the audit letter and explain what it really asks

- Organize records so the auditor sees a clear story

- Attend meetings and answer technical questions

This help keeps the review on track. You avoid giving extra records that raise new questions. You avoid emotional reactions that hurt your case. You protect your time, your business, and your sense of safety.

Quick comparison of doing it alone and using a CPA

| Audit Readiness Task | Without CPA | With CPA

|

|---|---|---|

| Recordkeeping system | Mixed receipts and unclear setup | Simple structure with clear rules |

| Risk review | Guessing about red flags | Planned review of high risk items |

| Support for numbers | Hunt for proof after audit notice | Proof stored and linked all year |

| Controls over money | One person handles everything | Shared duties and clear checks |

| During the audit | Face questions alone | CPA guides replies and records |

Take your next step today

Audit readiness is not a one-time event. It is a steady habit. A CPA helps you build that habit with clear rules, honest records, and strong support.

You protect your business. You protect your family. You also protect your peace of mind. Start by asking a CPA to review your books, your tax returns, and your controls. Then make a simple plan with three steps you can finish this year.

When an audit letter comes, you will not panic. You will already have proof, an order, and a trusted guide at your side.

BUSINESS

How Accounting Firms Help High Net Worth Individuals Protect Assets

You worked hard to build your wealth. Now you face lawsuits, taxes, and family conflict that can destroy it. High net worth brings comfort. It also brings exposure. You need a clear plan that shields what you own and supports the people you love. Accounting firms give you that plan. They track every dollar, reveal hidden weak spots, and design structures that keep assets out of reach from threats. In practice, that means smart entity choices, careful recordkeeping, and tax planning that does not cross legal lines. It means steady support when markets crash or laws change. If you use accounting in Northwest Iowa or across the country, the right team can coordinate with your attorney, banker, and advisor. Together they build a simple, strong defense around your wealth so you can protect your assets and focus on living.

Why High Net Worth Brings Higher Risk

Once your net worth grows, your name spreads. People know you have money. That attention draws lawsuits, business claims, and even pressure from relatives. It also brings close review from tax agencies.

Here are three common threats you face.

- Lawsuits from business partners, tenants, or customers

- Creditors after a failed deal or personal guarantee

- Family conflict over gifts, inheritances, or control

Each threat can reach your home, investments, and business shares if you leave them exposed. An accounting firm helps you see these risks before they explode.

How Accountants Build Asset Protection Walls

Accountants do more than file tax returns. They build money systems that separate, record, and protect. You get clear lines between your personal life and your business life.

Here are three core steps they use.

- Separate assets into different legal buckets

- Keep records that prove what belongs to each bucket

- Align tax moves with federal and state rules

The result is simple. You reduce what a lawsuit, creditor, or dispute can touch.

Using Entities To Shield Property

One key tool is the choice of entity. You might own rental houses, a family business, or a farm. If you hold all of it in your own name, one claim can hit everything. An accounting firm works with your attorney to place assets in entities that fit your goals.

Common structures include:

- Limited liability companies for rentals or side ventures

- Corporations for active businesses

- Family partnerships for shared investments

Each structure has different tax rules and protection rules. The Internal Revenue Service explains how these entities are taxed in the IRS business structures guide. An accountant reads those rules and shapes them around your situation. You gain protection without breaking the tax law.

Why Good Records Protect You In Court

Courts look at your records. If your books are sloppy, judges can treat your entities as fake. That move allows creditors to reach your personal accounts. An accounting firm keeps clean books that show real separation.

Strong recordkeeping does three things.

- Shows which entity owns each asset

- Tracks loans, gifts, and payments between family members

- Documents your tax choices with support

This proof can stop claims before they grow. It can also shorten audits and lower penalties if the IRS reviews your return.

Tax Planning That Reduces Exposure

High net worth means higher tax bills. It also means more chances to make mistakes that trigger audits. Accountants help you use legal tax rules that lower what you owe without crossing lines.

They look at:

- How gains and losses appear across your accounts

- How retirement plans fit your age and goals

- How gifts and inheritances affect estate tax

The IRS gives clear estate and gift tax rules at this estate and gift tax guide. Accountants use these rules to move assets to the next generation with less tax and less conflict.

Coordinating With Your Full Advisory Team

Asset protection works best when your team speaks often. Your accountant, attorney, banker, and investment advisor each see a piece. If they do not talk, gaps appear.

An accounting firm often serves as the hub. It sees every account and every transaction. It can:

- Flag when a business deal needs legal review

- Alert your banker before large moves

- Share tax impacts with your investment advisor

This steady contact keeps your plan current. It also lowers stress for you and your family.

Common Risks And Accounting Responses

| Risk | What Can Happen | How An Accounting Firm Responds

|

|---|---|---|

| Business lawsuit | Personal savings used to pay claims | Set up and track separate business entity records |

| Rental property accident | Other properties and accounts exposed | Place rentals in separate entities and keep clean books |

| Family dispute over money | Costly court battles and broken trust | Document gifts, loans, and ownership shares |

| Tax audit | Fines, interest, and stress for your family | Maintain support for every return and adjust plans to new rules |

| Sudden death or illness | Frozen accounts and confused heirs | Coordinate with estate attorney and map out asset transfers |

Protecting Your Family’s Future

Asset protection is not about hiding. It is about clarity, order, and fairness. You want your spouse, children, and causes to receive what you intend. You also want less fear during hard times.

A strong accounting partner helps you:

- See every asset on one clear list

- Match each asset with the right legal home

- Prepare your family for change and loss

You cannot control lawsuits, markets, or health. You can control how exposed your wealth remains. With the right accounting support, you place strong walls around what you built and give your family more peace.

BUSINESS

The Feel-Good Effect: Why Even Tiny Wins Can Boost Your Confidence

Why Small Wins Matter More Than You Think

In everyday life, big achievements often get all the attention. Graduations, promotions, major financial success these milestones are easy to celebrate. Yet, what many people overlook is the powerful impact of small wins. These tiny victories, whether finishing a simple task or experiencing a bit of unexpected luck, quietly shape our confidence, motivation, and overall well-being.

Even something as modest as completing a to-do list item or receiving a small financial reward can shift your mindset in a positive direction. Over time, these moments build emotional momentum that supports bigger successes.

The Psychology Behind Small Wins

When you experience a small win, your brain responds immediately. It releases dopamine, a chemical associated with pleasure, motivation, and reward. This reaction doesn’t just make you feel good for a moment—it encourages you to keep going.

Each small success signals to your brain that progress is happening. This creates a cycle: achievement leads to motivation, and motivation leads to more achievement. Think of it like climbing a staircase. One step may seem insignificant, but it’s necessary to reach the top.

Research in psychology shows that breaking large goals into smaller, achievable steps increases persistence and reduces overwhelm. Small wins make progress feel manageable and real.

How Positive Emotions Expand Your Thinking

Positive emotions triggered by small wins do more than boost mood. According to the broaden-and-build theory, feeling good expands the way you think. When your mind is open and relaxed, you become more creative, flexible, and better at solving problems.

These moments of positivity help you:

-

Think more clearly

-

Explore new ideas

-

Build emotional resilience

Over time, repeated small victories strengthen your ability to handle challenges and adapt to change.

Small Wins Build Confidence Over Time

Confidence doesn’t appear overnight. It grows from consistent proof that you are capable. Small wins provide that proof daily.

Every completed task, no matter how minor, reinforces the belief that you can follow through. This sense of progress fuels self-trust, which then carries into bigger responsibilities and goals.

A simple example is making your bed in the morning. It takes only a few minutes, but finishing it gives you an immediate sense of accomplishment. That feeling often sets a productive tone for the rest of the day.

The Ripple Effect of Small Successes

Small wins don’t stay isolated. Their effects ripple outward into other areas of life. When you feel good about what you’ve accomplished, you tend to:

-

Perform better at work

-

Communicate more positively with others

-

Feel more optimistic about the future

Positive emotions also strengthen social connections. When you’re in a good mental state, you’re more open, supportive, and engaged qualities that deepen relationships and build strong support systems.

Financial Wins and Mental Well-Being

Interestingly, studies show that even modest financial gains—such as a small bonus or a minor lottery win—can improve mental well-being. While these amounts may not change your lifestyle, they often provide a meaningful psychological boost.

This boost can increase optimism, reduce stress, and encourage a more hopeful outlook. While the effect may not last forever, it can create a lasting shift in how people perceive opportunities and challenges.

Why Small Wins Are Often Ignored

Many people dismiss small wins because they don’t seem impressive or worthy of celebration. Society often teaches us to focus only on big outcomes. But ignoring small progress can lead to burnout, frustration, and self-doubt.

Recognizing small victories helps maintain balance. It reminds you that growth is happening even when the finish line still feels far away.

How to Create More Small Wins in Daily Life

You don’t have to wait for luck to experience small wins. You can create them intentionally by:

-

Breaking big goals into smaller steps

-

Completing one task at a time

-

Acknowledging effort, not just results

-

Taking a moment to reflect on progress

These habits make success feel more frequent and achievable.

Conclusion

Small wins may seem insignificant at first, but their impact is powerful and lasting. They boost confidence, improve mental well-being, and create positive momentum that fuels larger achievements.

Whether it’s completing a simple chore, reaching a daily goal, or experiencing a small stroke of luck, every win matters. By recognizing and celebrating these moments, you build a stronger, more resilient mindset—one that’s prepared for long-term success and personal growth.

BUSINESS

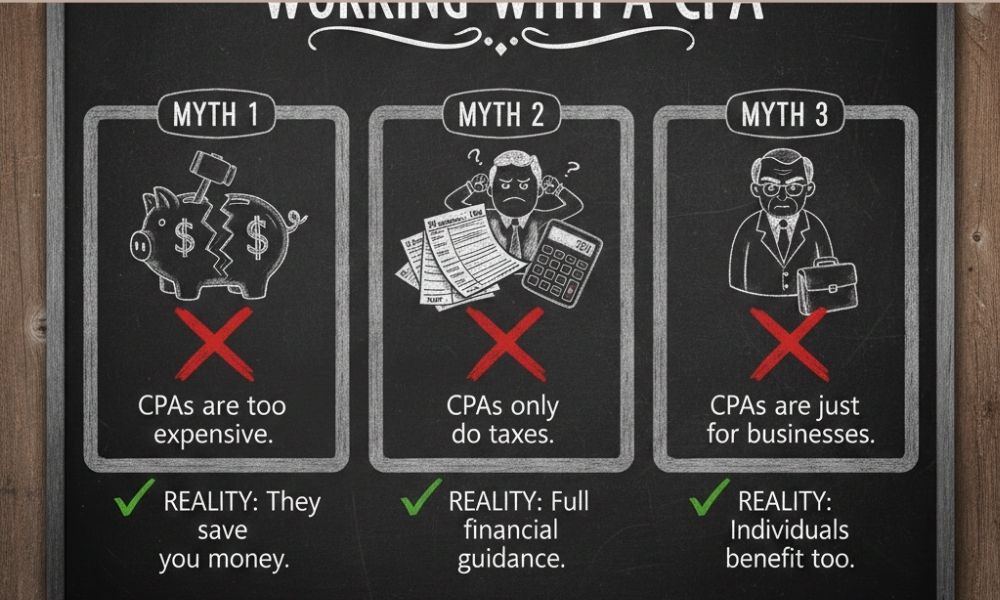

3 Common Myths About Working With A CPA

You work hard for your money. You want to trust the person who helps you with it. Yet many people hear “CPA” and feel fear, shame, or doubt. Some think a CPA only matters for the very rich. Others think using tax software is always enough. Many also believe a CPA will judge every choice or lecture about every receipt. These myths keep you stuck, worried about mistakes and surprise tax bills. They also stop you from using support that could calm your stress. In this blog, you will see three common myths about working with a CPA and what is actually true. You will also see how an Allen, TX CPA can guide you with clear steps, plain language, and steady support. You deserve calm, not confusion.

Myth 1: “A CPA is only for the wealthy”

This myth hurts many working families. You may feel your income is too small or your life is too simple. You may think a CPA would see you as a waste of time. That belief is false.

Here is the truth. A CPA is most useful when money feels tight. Small mistakes cost you more when you have less room in your budget. A missed credit or deduction can mean lost refund money you needed for rent, food, or child care.

The Internal Revenue Service explains that many credits support low and moderate-income workers and parents. For example, the Earned Income Tax Credit and Child Tax Credit can cut your tax or raise your refund. You can read about these credits at the IRS site here: https://www.irs.gov/.

A CPA helps you:

- See which credits you can claim

- Report income from more than one job

- Handle tips, gig work, or cash pay

Many families now have side work. Rideshare, food delivery, online sales, or home crafts all bring tax rules. A CPA helps you manage that work so you do not face a tax bill you did not expect.

Here is a simple view of when a CPA often helps. It is not about being rich. It is about your money picture.

| Life situation | Risk if you go alone | How a CPA helps

|

|---|---|---|

| One job, no kids | Low, but you may miss easy credits | Checks return, sets you up for future years |

| Kids or dependents | Medium, credits can be large and complex | Claims all credits, avoids payback later |

| Gig or cash work | High, surprise tax and penalties | Plans for tax, tracks costs, lowers shock |

| Debt, divorce, or support payments | High, rules change, refund, and income | Explains choices, prevents conflict and error |

| New home or move across states | Medium, property and state rules differ | Lines up state, local, and federal rules |

Your income level does not decide if you “deserve” a CPA. Your stress level and your risk do.

Myth 2: “Tax software is always enough”

Tax software can be useful. It can guide you through many screens and simple steps. Yet software only works with what you type in. It cannot sense your fear, shame, or silence. It cannot stop you and say, “Slow down. Something here does not match.”

Many people rush through screens late at night. You click yes or no without full thought. You may guess at numbers. You may skip questions that feel hard. Software will still file the return. The risk moves to you.

The IRS shares that common mistakes include wrong Social Security numbers, missing income forms, and math errors. You can see frequent errors here: https://www.irs.gov/. Software can reduce some of those. It cannot fix income you forgot to enter or life details you chose to hide.

A CPA does three things software cannot do.

- Asks hard questions in a calm way

- Listens to your story and spots patterns

- Plans for the year ahead, not just last year

Consider this simple comparison.

| Need | Tax software | CPA

|

|---|---|---|

| Basic filing for one job | Often enough | Useful if you feel unsure |

| Multiple jobs or gig income | May miss rules on costs and self-employment tax | Sorts income types and plans for tax |

| Letters from IRS | Gives general tips | Reads the letter and responds for you |

| Year round money planning | Almost none | Sets up steps for saving and tax |

| Stress and fear support | No human support | Gives calm, clear talk in plain words |

Software is a tool. A CPA is a guide. You can use both. You do not need to choose one for life. You can start with software and move to a CPA when life grows more complex or when fear grows too loud.

Myth 3: “A CPA will judge or shame me”

This myth keeps many people silent. You may feel embarrassed about debt, late bills, or old tax years. You may fear harsh words or cold looks. You may think a CPA only respects “perfect” records.

The truth is different. A good CPA sees messy records every day. Late filings, lost forms, and confusing letters are normal. Money stress is common. You are not alone, and you are not a failure.

Here is what you can expect from a steady CPA.

- Clear talk without blame

- Simple steps in small pieces

- Focus on fixing, not judging

You bring your pay stubs, bank records, and any letters from tax agencies. The CPA sorts and groups them. You work together to fill gaps. If you owe tax, you review payment choices. If you fear past years, you build a plan to catch up one year at a time.

You stay in control. You decide what to do next. The CPA gives you facts and options. That shared work builds trust and peace of mind.

How to choose a CPA who fits your family

You deserve someone who treats your money with respect. You also deserve someone who treats you with respect. Look for three things.

- Plain language. The CPA explains your return in words you understand.

- Clear fees. You hear the price and what is included before work starts.

- Year round support. You know how to reach the CPA if a letter comes later.

You can check licenses with your state board of accountancy. You can also ask if the CPA has experience with people who share your situation. For example, gig workers, retirees, single parents, or new business owners.

When you sit down with a CPA, you should feel heard, not rushed. You should leave with three things. You should know what was done, why it was done, and what you need to do next.

Move from fear to control

Money fear grows in silence. Myths feed that silence. When you learn the truth about CPAs, you gain options. You can ask better questions. You can protect your family from surprise bills and wasted refunds.

You do not need perfect records to start. You only need an honest picture of where you stand right now. From there, a CPA can help you build a simple plan. One step at a time. One year at a time. Your money story can change.

-

CELEBRITY1 year ago

CELEBRITY1 year agoLinda Susan Agar: A Visionary Leader Shaping the Future of the Technology Industry 2024

-

CRYPTO1 year ago

CRYPTO1 year agoeCrypto1.com Crypto Wallets: The Ultimate Guide to Secure and Efficient Cryptocurrency Storage 2025

-

CELEBRITY1 year ago

CELEBRITY1 year agoThe Viral “Emiru Handbra” Moment: How It Became a Stunning Social Media Sensation in 2024

-

CELEBRITY1 year ago

CELEBRITY1 year agoThe Life and Legacy of Harlow Andrus: A Journey of Heritage and Inspiration 2024

-

FASHION1 year ago

FASHION1 year agoMcKinzie Valdez: Journey from Social Media Star to Entrepreneur 2024

-

CELEBRITY1 year ago

CELEBRITY1 year agoMatt Danzeisen: The Quiet Yet Powerful Figure Behind Peter Thiel’s Success 2024

-

CELEBRITY1 year ago

CELEBRITY1 year agoWho is Josie Lynn Shalhoub’s? Tony Shalhoub’s Daughter

-

CELEBRITY1 year ago

CELEBRITY1 year agoTiffany Pesci: The Private Life and Career of Joe Pesci’s Daughter 2024