BUSINESS

How CPAs Support Small Business Growth

Small businesses often face challenges that can feel overwhelming. Yet, you don’t have to tackle them alone. A Certified Public Accountant (CPA) is your partner in navigating these challenges. CPAs offer expertise that can support your business in multiple ways. From managing financial records to strategic tax planning, their guidance is invaluable. Consider a Hanover tax accountant. They can help you keep your finances healthy. With accurate financial reporting and tax compliance, you make informed decisions that spur growth. You gain insights that help streamline your operations. Your CPA also ensures you stay up-to-date with changing tax laws, avoiding costly penalties. By focusing on your financial health, you devote more time and energy to what you do best: running your business. A CPA acts as a reassuring presence, guiding you through complex processes and providing a stable groundwork for your business’s future. Your path to success becomes more manageable.

Financial Management

Effective financial management is key to business success. CPAs prepare and analyze financial statements, giving you a clear picture of your financial health. This clarity helps you make informed decisions. When you understand your cash flow, expenses, and profits, you can plan strategically. Accurate record-keeping also ensures you stay compliant with regulations.

Tax Planning and Compliance

Tax laws change frequently. Keeping up can be a daunting task. CPAs stay informed about these changes, ensuring your business remains compliant. They identify tax-saving opportunities and help you avoid penalties. With their support, you maximize deductions and credits. This strategic approach enhances your financial standing and frees resources for growth.

Business Growth Strategies

Growing a business requires more than hard work. You need strategies grounded in solid financial understanding. CPAs provide insights into market trends and consumer behavior. They help you evaluate investment opportunities and assess risks. With their expertise, you develop strategies that align with your business goals.

Budgeting and Forecasting

A well-planned budget is crucial. CPAs assist in creating realistic budgets. They analyze past financial data to forecast future trends. This foresight helps you allocate resources effectively. As your business grows, having a clear budget ensures you can tackle challenges and seize opportunities confidently.

Comparison of CPA Services

| Service | Description | Benefit |

|---|---|---|

| Financial Reporting | Preparation and analysis of financial statements | Informed decision-making |

| Tax Compliance | Ensuring adherence to tax laws and regulations | Maximized tax savings and avoidance of penalties |

| Business Strategy | Insights into market trends and strategic planning | Aligned business goals |

| Budgeting | Development of realistic financial plans | Effective resource allocation |

Risk Management

Every business faces risks. Identifying and managing these is crucial. CPAs conduct risk assessments. They help you develop plans to mitigate potential threats. By understanding financial risks, you safeguard your business’s future. You protect your assets and maintain stability even in challenging times.

Technology Integration

Technology improves efficiency. CPAs guide you in selecting and implementing financial software. This integration streamlines processes and enhances accuracy. By adopting the right tools, you improve productivity. You also gain access to real-time data, helping you make quick, informed decisions.

Conclusion

CPAs are invaluable partners in business growth. They provide expertise in financial management, tax planning, and strategic development. By working with a CPA, you navigate challenges confidently and focus on what truly matters: growing your business. Visit the IRS Small Business and Self-Employed Tax Center for more information on how CPAs can assist you.

BUSINESS

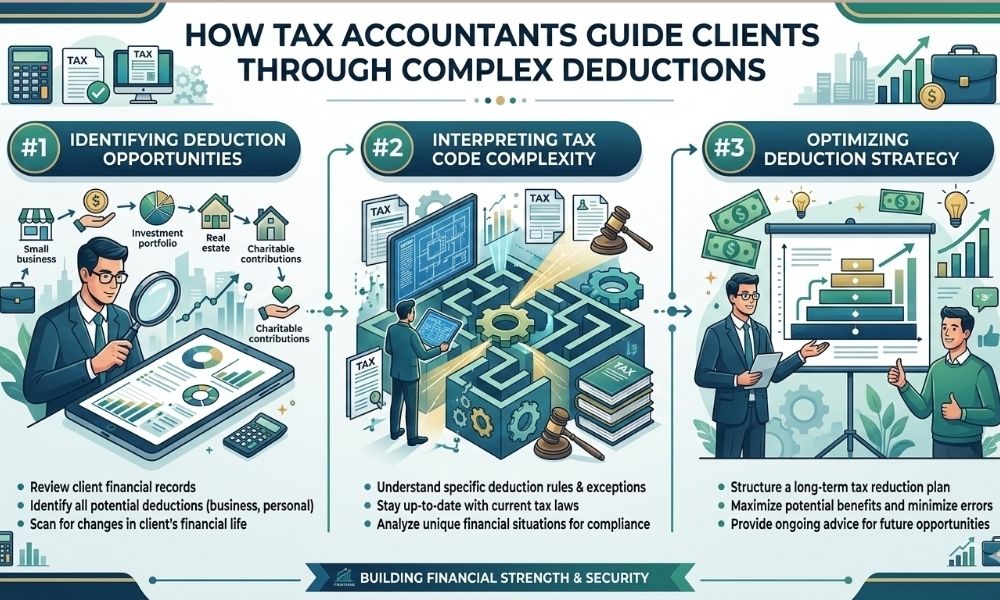

How Tax Accountants Guide Clients Through Complex Deductions

Tax rules can feel like a trap. One wrong choice and you lose money you need. Complex deductions create the most confusion. Medical costs, home offices, and business expenses each come with strict rules. Every line on a tax form can raise questions. A tax accountant helps you move through this pressure with a clear plan. You learn which records to keep, which receipts matter, and which numbers to leave out. You also see how one decision can change your refund or your tax bill. Through patient questions and direct answers, a tax accountant turns confusing rules into clear steps. This support is true whether you run a company, rent out a basement, or manage family bills. It is also true for people who work with accounting in West Seattle and for those who live far away. You do not have to face complex deductions alone.

Why Complex Deductions Feel So Overwhelming

Tax forms use short phrases that hide strict rules. You see words like “qualified,” “ordinary,” or “reasonable.” You guess at what they mean. The tax code uses exact meanings instead. A tax accountant knows those meanings. You get a clear yes or no instead of a guess.

Three things often cause the most strain:

- Unclear recordkeeping

- Mixed personal and business costs

- Fear of an IRS notice or audit

An accountant works through each of these with you. You do not have to carry the worry alone.

How Tax Accountants Turn Confusion Into Clear Steps

A good tax accountant does more than fill out forms. You get a process that repeats each year. That process usually follows three simple stages.

1. Understand Your Life, Not Just Your Numbers

The first step is a real talk about your life. You share how you earn money, how you spend it, and what changed this year. You may talk about:

- Job changes or side work

- Child care, college, or elder care costs

- Medical needs and insurance choices

- Home moves, home offices, or rental units

This talk helps your accountant spot deductions you might miss. It also keeps you from claiming ones you cannot support.

2. Sort Your Records Into Clear Groups

Next, you sort numbers into clear buckets. You learn which receipts and documents to keep together. Common groups include:

- Medical bills and insurance statements

- Mortgage interest and property tax records

- Charity letters

- Business or side gig costs

The IRS shares record tips in its guide on recordkeeping. You can read more at this IRS recordkeeping page. An accountant uses these same rules and shows you how to follow them with less stress.

3. Match Your Life To Specific Deductions

Once your records are set, your accountant matches them to tax rules. You see each deduction in plain terms. You learn:

- Who can claim it

- What counts and what does not

- What proof you should keep

Then you decide together which deductions to claim now and which to plan for next year.

Common Complex Deductions And How Accountants Help

Some deductions cause more anxiety than others. Here are three that often raise hard questions.

Medical And Dental Expenses

Medical costs can drain a family. The IRS allows you to deduct some costs that pass a set limit of your income. The challenge is knowing what counts. An accountant helps you sort:

- Doctor and hospital bills

- Prescription drugs

- Some travel for medical care

You can see the IRS rules in Publication 502 on medical and dental expenses. An accountant uses this guide and your records to see if itemizing makes sense for you.

Home Office Deduction

More people now work from home. Many wonder if they can claim a home office deduction. The rules are strict. The space must be used only for work and be your main place of business. An accountant:

- Reviews how you use the space

- Explains the “simplified” and “regular” methods

- Shows how the choice affects your tax and record needs

You gain clarity and avoid risky claims.

Business And Side Gig Expenses

If you run a small business or side gig, you face extra rules. You may mix personal and business spending. A tax accountant helps you draw a firm line. You learn how to track:

- Home internet and phone used for work

- Mileage for work travel

- Equipment and software

This protects you if the IRS asks questions later.

Standard Deduction Or Itemized Deductions

One of the first big choices each year is whether to take the standard deduction or itemize. This choice shapes every other step. An accountant compares both paths using your real numbers.

| Choice | What It Means | Good Fit When

|

|---|---|---|

| Standard deduction | Flat amount set by law. No need to list each cost. | You have a few deductible expenses. Your mortgage, medical, and charity costs are low. |

| Itemized deductions | You list each qualified cost, such as medical, taxes, and charity. | Your total deductible costs are higher than the standard deduction. |

| Mixed review | Your accountant tests both choices with your records. | Your totals are close. You want to see which path saves more. |

This clear comparison eases fear. You see the numbers, then choose the path that protects more of your income.

Planning With Your Accountant All Year

Tax work should not start in a rush each spring. You gain more when you stay in touch with your accountant during the year. Three moments matter most:

- Before you take on new work or a side gig

- Before you sell a home or rental

- Before you pay high medical or education costs

Each of these choices can change your tax bill. Early advice can turn a shock into a planned step.

Protecting Your Family And Your Peace Of Mind

Complex deductions are not a test of your worth. They are rules on paper. With the right guide, those rules stop feeling like a trap. A tax accountant helps you protect your income, support your family, and face tax season with less fear. You bring your story and your records. You leave with clear steps, honest answers, and more control over the money you work hard to earn.

BUSINESS

How Cp As Serve As Trusted Partners In Wealth Preservation

Wealth can feel fragile. Markets change. Laws shift. One wrong move can erase years of effort. In this pressure, you need more than tax help. You need a steady partner who understands your money, your risks, and your goals. That is where skilled CPAs step in. They track every rule that touches your income, your property, and your estate. They spot quiet threats before they grow. They also help you keep more of what you earn, year after year. If you work with an Accounting firm in Santa Monica you gain a team that watches both numbers and human needs. They look at your family, your business, and your future plans. Then they build clear steps to protect what you built. This blog explains how CPAs become true partners in wealth preservation and why that partnership can mean the difference between short success and lasting security.

Why Wealth Preservation Needs More Than Investing

Wealth preservation is not only about stocks or property. It is about keeping what you earn when laws, health, and family needs keep changing. A CPA looks at three core questions.

- How much do you keep after tax each year

- What happens to your money if you die or become sick

- How secure is your income if work or business slows down

Each answer rests on clear rules. The tax code, estate rules, and business rules change often. The IRS lists new updates every year in its tax guidance. A CPA follows these shifts and adjusts your plan so your savings do not leak away through surprise bills or missed steps.

The CPA’s Role In Your Financial Life

You might think of a CPA as someone who files tax returns. That task is only one piece. A trusted CPA supports you across your life stages. Childhood, working years, and retirement.

- Early career. Set up smart saving habits and retirement accounts

- Family years. Plan for college, housing, and care for aging parents

- Business growth. Structure your company to protect income and limit risk

- Retirement. Manage withdrawals and required minimum distributions

- Legacy. Plan how money passes to children or charities

The U.S. Securities and Exchange Commission warns that emotional decisions often hurt long-term results. Their investor education pages explain how planning helps reduce fear and rushed moves. A CPA uses that same steady mindset. You gain a calm voice when markets fall or when a big life event hits.

Key Ways CPAs Protect Your Wealth

A good CPA uses clear methods to guard your money. Three stand out.

1. Strategic Tax Planning

Taxes are often your highest yearly cost. Careful planning can free money for saving or giving. A CPA can help you

- Choose the right filing status

- Use credits for children, education, or energy upgrades

- Place investments in the right accounts

- Plan stock sales to manage gains

- Time big gifts or donations

Each step reduces waste. You keep more without cutting back on your life.

2. Risk Management And Protection

Wealth can drain from lawsuits, illness, or failed deals. A CPA reviews your whole picture. Income, property, debts, and business exposure. Then the CPA works with your attorney and insurance agent. Together they help you

- Use the right business structure

- Track and separate personal and business costs

- Review coverage for health, life, and disability

- Plan for care needs in old age

This team approach protects you from shocks that can wipe out savings.

3. Estate And Legacy Planning Support

Many people avoid talking about death or disability. The result is confusion, family conflict, and large tax bills. A CPA helps you face these topics with clear facts. You can

- List all accounts and property

- Plan who will receive what and when

- Reduce possible estate taxes

- Set up a plan for children or family members with special needs

This process gives your family clarity and peace. It also keeps courts and taxes from taking control.

CPA Support For Families And Small Business Owners

Families and small business owners often carry the most strain. You may feel pulled between saving for your children and keeping a business alive. A CPA can help you

- Build a simple budget that respects your values

- Track cash flow for your home and business

- Set pay for yourself that is fair and safe

- Plan for a business sale or handoff to family

This support gives you room to care for children, parents, and workers without losing your own future.

How CPAs Compare To Other Financial Helpers

| Partner Type | Main Focus | Key Strength | Common Limits

|

|---|---|---|---|

| CPA | Taxes, reporting, and long-term planning | Deep knowledge of tax law and record keeping | May not manage investments directly |

| Financial Planner | Saving and investing plans | Helps set and track money goals | May not focus on detailed tax rules |

| Attorney | Legal rights and documents | Drafts wills, trusts, and contracts | May not review yearly money habits |

| Insurance Agent | Risk coverage | Understands policy choices | Focuses on products, not full money picture |

The strongest results come when your CPA works with these partners. Each brings a piece. Your CPA helps connect the pieces into one clear plan.

Choosing A CPA As A Long-Term Partner

You trust a CPA with private details about your income, debts, and fears. You deserve someone who earns that trust. When you meet a CPA, ask

- What experience do you have with people like me

- How do you charge for your work

- How often will we talk each year

- Do you coordinate with my planner and attorney

Notice how the CPA explains things. You should feel heard and respected. You also should leave with clear steps, not confusion.

Turning Uncertainty Into A Clear Plan

Money fear can feel heavy. You may worry about job loss, illness, or how your children will cope after you are gone. You do not need to carry that alone. A CPA can help you face hard facts, accept limits, and use the rules to your benefit.

First, gather your records. Second, talk openly about your hopes and fears. Third, follow through on the plan you built together. With that partnership, wealth preservation becomes less about luck and more about steady, honest choices that protect the people you love.

BUSINESS

Why Businesses Trust Accountants With Strategic Decision Making

You face hard choices every day. You weigh payroll, taxes, growth, and risk while trying to keep your doors open. In those moments, you need more than a bookkeeper. You need someone who can read your numbers like a map and warn you before trouble hits. That is why many owners turn to accountants for strategic decisions. They see patterns in cash flow, pricing, and debt that you may miss. They test ideas with real data, not guesses. They ask sharp questions that protect your money and your staff. A strong accountant works as your sounding board, risk guard, and growth partner. Many firms now offer deeper support through services such as Portland business consultant and advisory. This support gives you clear choices, plain language, and steady guidance so you can act with less fear and more control.

Why numbers guide better choices than guesses

Every choice has a cost. You hire one person and give up another. You open a new site and strain your cash. When you guess, you lean on hope. When you use your numbers, you lean on proof.

Accountants turn raw records into simple answers to three hard questions.

- Can you afford this choice right now

- What do you risk if you wait

- How will this move change your cash in three, six, and twelve months

They pull reports from your books. Then they sort the noise from the signals. They show you what is steady and what is slipping. That clarity lowers fear and stops rushed moves.

How accountants support long term planning

Strategy is not a slogan. It is a chain of small choices that line up with one clear goal. Accountants help you build and keep that chain.

They do three key things for long-term planning.

- Set simple money targets for revenue, profit, and cash

- Check progress each month and flag gaps early

- Adjust plans when the economy or your costs change

The Federal Reserve provides data on business credit, rates, and trends. You can see this public data at the Federal Reserve Economic Data site. Accountants use facts like these to test your plans against real shifts in the economy. That gives you planning that is grounded, not hopeful.

Compliance as a base for smart risk taking

You cannot plan growth if you worry about audits or missed rules. Accountants keep your records clean and your filings on time. That calm base lets you take smart risks.

They watch three pressure points.

- Tax rules that change what you keep from each sale

- Payroll and benefits rules that affect hiring choices

- Recordkeeping rules that protect you in an audit

The Internal Revenue Service explains record rules for small businesses at the IRS Recordkeeping page. Accountants use guidance like this to build simple systems that you and your staff can keep up with each day.

Comparing bookkeepers and strategic accountants

Many owners use the word accountant for any money helper. Yet the role can be very different. The table below shows key contrasts.

| Function | Bookkeeper focus | Strategic accountant focus

|

|---|---|---|

| Main purpose | Record past activity | Guide future choices |

| Time frame | Day to day and month end | Next quarter and next year |

| Key tools | Ledgers and basic reports | Cash forecasts and budgets |

| Typical questions | What happened | What should happen next |

| Risk view | Spot obvious errors | Weigh outcomes and tradeoffs |

You may need both roles. Yet you place deep trust in the person who helps you pick a path. That is why owners lean on accountants who can step beyond records and speak about outcomes.

Turning raw data into simple choices

Numbers alone do not help. You need the story behind them. Skilled accountants translate complex reports into plain words. This translation helps you act, not freeze.

They often structure advice in three clear paths.

- Safe path. Hold cash, slow hiring, protect what you have

- Balanced path. Add some costs and test new offers

- Bold path. Invest more, accept higher short-term strain

You then choose the path that fits your risk comfort and your family’s needs. You stay in control. The accountant supplies guardrails.

Why trust grows over time

Trust does not come from one tax season. It grows through repeated tests. Over several years, you see how often your accountant was honest and clear. You notice three things.

- They tell you what you need to hear, not what you want to hear

- They admit limits and pull in other experts when needed

- They protect both your business and your home life

Many owners share money worries with no one else. An accountant hears these fears, keeps them private, and answers with facts. That mix of care and blunt truth builds strong trust.

Working with a consultant and advisory partner

Some firms blend accounting, tax, and business coaching. Services such as a business consultant can bring numbers, planning, and coaching into one steady relationship.

In this setup, you get three supports.

- Regular check-ins on cash, profit, and debt

- Simple scorecards that your whole team can track

- Clear next steps after each review

This steady rhythm turns strategy from a one-time event into a habit. You stop reacting in fear and start acting with intent. You gain a partner who knows your history and keeps your long-term goals in view.

How to choose the right accountant for strategic help

You deserve someone who respects your work and your time. When you interview accountants, look for three signs.

- They ask questions about your goals, not just your forms

- They explain reports in words you can use with your staff and family

- They offer a clear plan for how often you meet and what you will review

Trust grows when you see that your adviser cares about both your numbers and your stress level. With the right accountant, you face decisions with more courage and less doubt. Your numbers stop being a source of fear and start being a source of power.

-

CELEBRITY1 year ago

CELEBRITY1 year agoLinda Susan Agar: A Visionary Leader Shaping the Future of the Technology Industry 2024

-

CRYPTO1 year ago

CRYPTO1 year agoeCrypto1.com Crypto Wallets: The Ultimate Guide to Secure and Efficient Cryptocurrency Storage 2025

-

CELEBRITY1 year ago

CELEBRITY1 year agoThe Life and Legacy of Harlow Andrus: A Journey of Heritage and Inspiration 2024

-

CELEBRITY1 year ago

CELEBRITY1 year agoThe Viral “Emiru Handbra” Moment: How It Became a Stunning Social Media Sensation in 2024

-

FASHION1 year ago

FASHION1 year agoMcKinzie Valdez: Journey from Social Media Star to Entrepreneur 2024

-

CELEBRITY1 year ago

CELEBRITY1 year agoMatt Danzeisen: The Quiet Yet Powerful Figure Behind Peter Thiel’s Success 2024

-

CELEBRITY1 year ago

CELEBRITY1 year agoDeja Jackson, Ice Cube’s daughter, basketball career, biography 2024

-

CELEBRITY1 year ago

CELEBRITY1 year agoElizabeth Rizzini Biography | Career | Personal Life and More